Are Trust Distributions Taxable?

When a trust settlor passes away, the successor trustee will ultimately distribute the trust assets to the trust beneficiaries. Many beneficiaries may wonder: Are trust distributions taxable? Paying taxes on trust distributions can be complex, but here are some important things to know.

What is a Trust?

A trust is a legal arrangement in which one party (the “settlor” or “grantor”) gives property or money to another party (the trustee) to hold and oversee for the benefit of a third party (the beneficiaries).

The most common type of trust in California is a revocable living trust, which takes effect while the settlor is still alive and can be altered at any time during the settlor’s lifetime. After the settlor becomes dies, their successor trustee will take over managing the trust and distribute the trust assets to the beneficiaries.

There are also irrevocable trusts that may be used because of the tax benefits they offer. A few examples of irrevocable trusts include Irrevocable Defective Grantor Trusts, Life Insurance Trusts, Special Needs Trusts, and Charitable Remainder Trusts.

What Is a Trust Beneficiary?

A trust beneficiary is a person or entity to whom the trust settlor wishes to leave part of their estate. Often these are the loved ones of the trust settlor, but beneficiaries may also be a nonprofit, such as a charity, church, or educational institution.

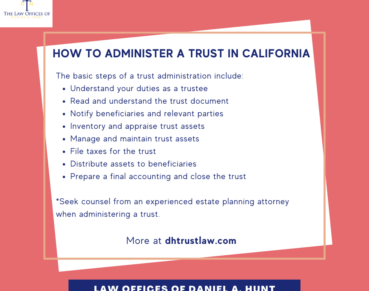

Types of Trust Distributions

Beneficiaries generally get payments (called “distributions”) from the trust in one of three ways:

- Outright distribution: This is a lump payment with no restrictions.

- Staggered distribution: This means the distributions are received over a period of time, often in a set amount each time or after a specific triggering event, like college graduation or the birth of their first child.

- Discretionary distribution: This means the distributions are determined at the discretion of the trustee, in alignment with the settlor’s wishes.

Income versus Principal

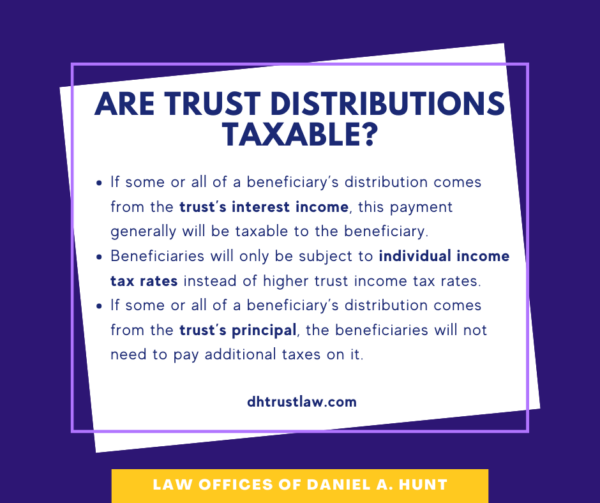

No matter how often they are received, whether or not trust distributions are taxable depends on whether they come from the trust income or trust principal.

Distributions From Trust Income

If some or all of a beneficiary’s distribution comes from the trust’s interest income or pecuniary gain, this payment generally will be taxable to the beneficiary. The exception would be if the trust has already paid the income tax on the gain. But on the bright side, when the beneficiaries receive taxable income, the amount will only be subject to individual income tax rates instead of higher trust income tax rates.

The trust can deduct any interest income distributed to beneficiaries from its taxes. But interest income not distributed before the end of the year is typically subject to trust income tax rates.

Distributions From Trust Principal

If some or all of a beneficiary’s distribution comes from the trust’s principal, the IRS assumes that the settlor already paid taxes on it before transferring it into the trust. This means that beneficiaries will not need to pay additional taxes on it.

For example, if the family home or cash on hand at death is distributed from the trust to a trust beneficiary, the beneficiary would not pay income taxes on that distribution.

Trust Distribution Tax Forms

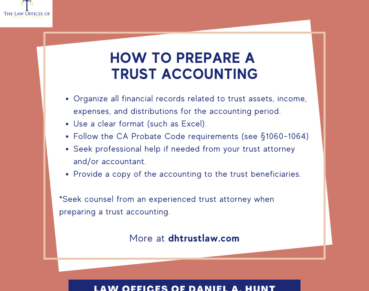

Trustees have a responsibility to inform the IRS of trust distributions by filling out the appropriate paperwork. This includes:

- A trust income tax return, or form 1041. This form allows the trustee to deduct the beneficiary distribution from the trust’s taxable income.

- A K-1 form for each beneficiary. This form lists how much of the beneficiary’s distribution came from income versus principal. The trustee will send the beneficiaries this form which they will use to file their personal tax return. They will also send it to the IRS so they can confirm the information aligns with the 1041 form.

Seek Professional Guidance

Navigating these complex tax questions can be intimidating, but you don’t need to do it alone. Whether you’re a trustee or a beneficiary, seek guidance from an experienced estate planning attorney and a tax professional. They can help you complete the required paperwork and pay the required taxes for your specific circumstances.

If you have any questions about whether trust distributions are taxable, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.